News

The Impact of Epidemic on the China’s Condom Industry

The Covid-19 pandemic - especially for condom makers - is widely expected to lead to a surge in sexual activity and a huge demand for condoms as couples are locked in their homes with nothing to do. However, the exact opposite happened.

At the beginning of the epidemic in April 2020, Malaysia's Karex Berhad, a world-renowned condom manufacturer with an annual output of 5 billion condoms, announced that its inventory could only be maintained for another two months, leaving a huge supply gap. However, two years later, Karex Berhad announced that condom sales had fallen by 40% since 2020.

The impact on Chinese condom manufacturers is very large:

According to the Tianyancha enterprise database, from 2020 to June 2022, 43,200 domestic condom-related companies have been closed, with an average annual closure of 17,300.

According to a domestic condom manufacturer, the domestic condom price has dropped again and again, and the manufacturer's sales have dropped by as much as 30%. Most second- and third-tier brands have disappeared, and the surviving brands can only barely survive.

Take Guilin Zizhu Latex Products as an example. Founded in 1966, it has long been one of the largest condom manufacturers in China and has just been sold to Winner Medical for 450 million yuan ($67.14 million).

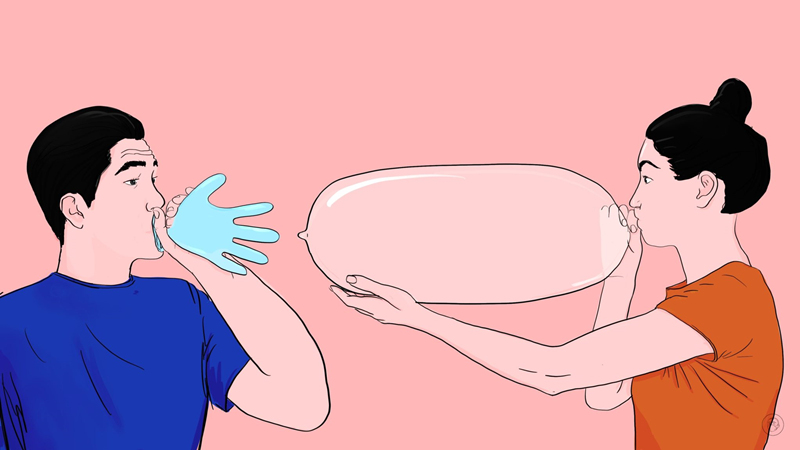

For many surviving domestic condom manufacturers, switching to latex gloves is a way out. According to the Tianyan Check database, since 2020, the number of newly registered enterprises producing medical protective gloves has reached 232,300. Even Karex Berhad has entered the medical glove manufacturing business, with plans to start production this year.

The economic and psychological, work stress, food, healthcare and even sleep brought on by Covid-19 and quarantine seem to have left people with little time for sexual and romantic inclinations.

In addition, advocating for having three children, many local government departments have reduced the number of condoms placed in community health service centers.

The Covid-19 pandemic has also shut down the tourism and hospitality industries, drastically reducing condom sales in hotels, which have been booming in the past. Nearly half of China's condom use occurs outside the home, according to figures cited in a June article by Southern Weekend, but demand for that category has been stifled by the coronavirus.

During previous world economic crises, condom sales have generally trended upward. For example, after the global financial crisis in 2008, sales soared, and many media reports said that people used intimacy to release pressure and divert attention.

This behavior in a state of prolonged anxiety has been described as the "lipstick effect", when cash-strapped consumers can't afford expensive luxury goods, but they can still buy some cheap non-essentials, such as "lipstick".

However, what happened during the new crown epidemic is quite the opposite. According to a global research article "An analysis of the impact of the new epidemic on sexual life" published in the American Journal of Sex Research (Journal of Sex Research) in early 2021, the sexual life before the new epidemic. Activity is 4.4 times higher than that during the epidemic.

Condom use is likely to start to increase as the Covid-19 pandemic subsides, but the government's advocacy of a three-child policy and a reduction in the distribution of free condoms could negatively impact the recovery of the condom industry.

CATEGORIES

LATEST NEWS

CONTACT US

Name: Ken Hu

Mobile:+86-139-02560713

Tel:+86-139-02560713

Whatsapp:+8613902560713

Email:ken@zulmate.com

Add:Songshan Lake District,Dongguan,China